Tax Season Tips 2025

Tax Season Tips 2025 - Complete guide to navigating 2025 tax season, Let’s assume that you’re a toronto resident and your taxable income in 2025 was $43,000. Navigating the 2025 Tax Season Tips and Timeline for your Tax Refund, The canada revenue agency has options for you if you owe us money or have a debt that we collect for another government department.

Complete guide to navigating 2025 tax season, Let’s assume that you’re a toronto resident and your taxable income in 2025 was $43,000.

YearEnd Tax Planning Tips You NEED to Know Before the 2025 Tax Season, But, in a matter of weeks, mr.

For 2025, the amt exemption amount is $85,700 and begins to phase out at $609,350. While we don’t expect you will cannonball into tax planning this second, below are six tips to help you get your tax feet wet for next season and ensure you get your biggest tax refund yet next year.

Navigating the 2025 Tax Season Tips from a Pro Accounting Firm u, They can claim this deduction only for expenses that weren't reimbursed by their.

Navigating the 2025 Tax Season Tips from a Pro Accounting Firm, As a gig worker or freelancer, you can contribute to your own retirement account.

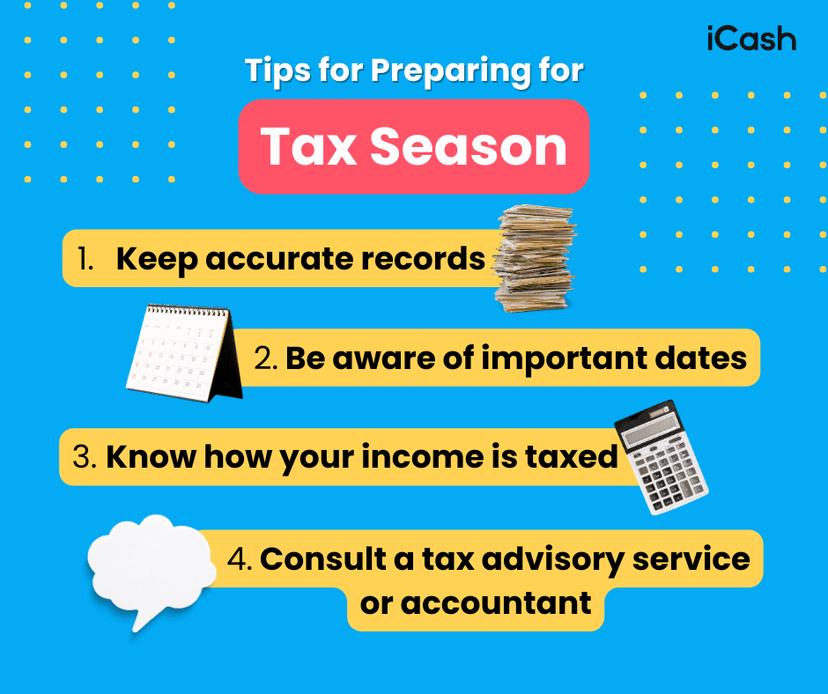

Tax Season Tips 2025. Oriana suarez january 17, 2025 tips. Make it easy on yourself for next year and stay organized.

2025 Tax Season Tips KidKare, Tcja allowed business owners to write off 100% of the costs of qualified assets that were placed in service between september 27, 2025, and january 1, 2023.

Tax Season 2025 Guide Filing Dates, Brackets, and Essential Tips New, Quickbooks, a popular accounting software for small businesses, allows you to electronically keep track of your financial records and reduce the amount of time you.

Yearend Tax Tips 2025 Tax Year RPJ Accounting, For tax season 2025, the standard deduction increased to $13,850 for single filers and $27,700 for married couples filing jointly.

TAX TIPS 2025 IRS STANDARD DEDUCTION FOR 2025 TAX SEASON YouTube, For married couples filing jointly, the amt exemption amount will be $133,300, beginning to phase out at.